ETH Price Prediction: Navigating Current Volatility for Long-Term Gains

#ETH

- Technical Support Levels: ETH is testing crucial support at $4,159 with potential for reversal or further decline

- Fundamental Strength: Whale accumulation and institutional interest provide strong underlying support despite price volatility

- Catalyst Events: Upcoming network upgrades and product launches could drive significant price appreciation in medium term

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Support Level

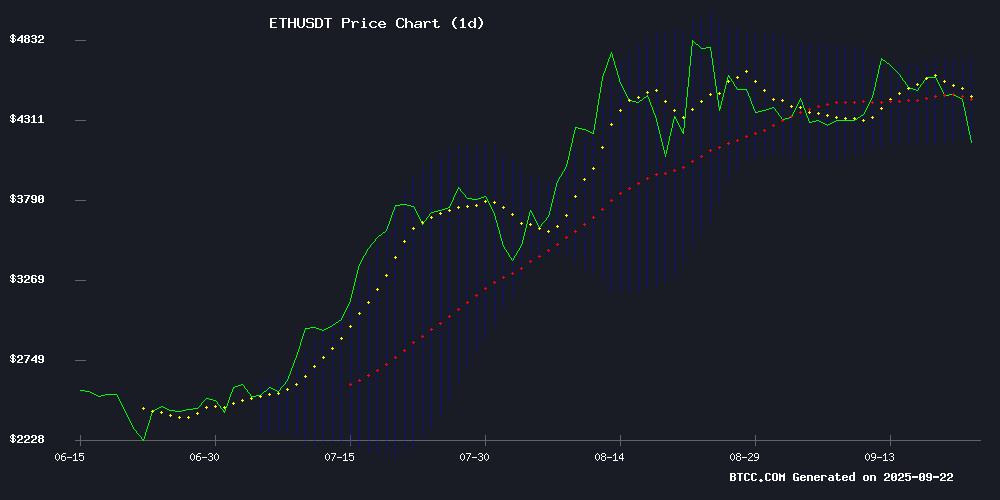

ETH is currently trading at $4,191.39, below its 20-day moving average of $4,441.56, indicating short-term bearish pressure. The MACD reading of -74.10 suggests ongoing downward momentum, though the Bollinger Bands show ETH trading NEAR the lower band at $4,159.09, which could indicate potential oversold conditions. According to BTCC financial analyst Ava, 'The current technical setup suggests ETH is testing crucial support levels. A bounce from the Bollinger lower band could signal a reversal opportunity, while a break below might trigger further declines toward $4,000.'

Market Sentiment: Bullish Fundamentals Counter Technical Weakness

Positive news flow surrounding ethereum continues to build, with headlines highlighting whale accumulation patterns, the potential $13,000 price target, and MetaMask's new stablecoin launch. BTCC financial analyst Ava notes, 'The fundamental narrative remains strongly bullish despite short-term technical weakness. Institutional accumulation through SharpLink's $3.75 billion treasury build and upcoming network upgrades create a compelling long-term investment case. However, traders should monitor the $4,150 support level closely.'

Factors Influencing ETH's Price

Ethereum Price Path to $13,000 Amid Whale Accumulation

Ethereum nears a critical resistance level at $4,875, its previous all-time high, as institutional interest and technical patterns signal potential for a major rally. Chart formations like the cup and handle suggest a continuation of bullish momentum, with analysts projecting targets up to $13,000.

Whale activity has intensified, with entities like BitMine accumulating billions in ETH. A breakout above $4,875 could propel Ethereum toward Fibonacci extension levels at $6,343 and $7,340—key profit-taking zones—before advancing to $8,864 and beyond.

Ethereum (ETH) Price Prediction: Cup & Handle Breakout Signals Potential $10K Rally

Ethereum trades at $4,478, showing resilience amid market volatility. Institutional inflows and staking adoption bolster liquidity, with analysts eyeing a breakout above $4,955 as a catalyst for a push toward $5,500.

The ETH/BTC correlation weakens as Ethereum's DeFi ecosystem and stablecoin demand fuel independent momentum. A cup-and-handle pattern suggests bullish continuation, potentially unlocking multi-month upside.

MetaMask Launches Dollar-Pegged Stablecoin mUSD

MetaMask has introduced MetaMask USD (mUSD), a dollar-pegged stablecoin integrated directly into its crypto wallet ecosystem. Launched on September 15, 2025, mUSD is available on Ethereum and Linea, MetaMask's layer-2 network, with full backing by cash and cash-equivalent assets. Bridge, a licensed entity, serves as the issuer and manages reserves under regulatory oversight.

The stablecoin, built using the M0 protocol, offers seamless swaps, transfers, and bridging within MetaMask's interface. Users can purchase mUSD via credit cards, bank transfers, or digital payment methods like Apple Pay and PayPal, with tokens delivered directly to their wallets. MetaMask also plans to integrate mUSD with its MetaMask Card, enabling spending at over 150 million Mastercard-accepting merchants worldwide.

MetaMask positions mUSD as the default stablecoin on Linea, aiming to capture transaction volume within its ecosystem. The move comes as the stablecoin market grows increasingly lucrative, with Tether reporting $4.9 billion in earnings in Q2 2025 alone. The sector remains dominated by established players like USDT and USDC.

Ethereum Price Outlook: Can ETH Break Above $5,000 Before Fusaka Upgrade?

Ethereum's price action is drawing intense scrutiny as it approaches the $5,000 psychological threshold ahead of the Fusaka upgrade on December 3. The second-largest cryptocurrency by market cap currently trades between $4,334.79 and $4,824.58, having rallied 125% over six months.

Technical indicators suggest room for further upside. The Relative Strength Index shows ETH isn't yet overbought, while a decisive break above the $5,040.32 resistance could open the path toward $5,530.11—a 14% gain from current levels. Market participants are weighing whether the network upgrade's promised ecosystem improvements will provide sufficient catalysts for sustained momentum.

This price movement carries broader implications for digital asset markets. Ethereum's performance often sets the tone for altcoins, and a successful breakout could reinforce bullish sentiment across the sector. Traders are monitoring whether institutional flows and derivatives positioning support continued appreciation as the upgrade deadline approaches.

AI Meets Augmented Reality With the $LIVE AR Crypto Presale

The $LIVE crypto presale marks the debut of LivLive's augmented reality layer, trading at $0.02 with a projected 12x return at launch. This Ethereum-based token bridges AR gaming, AI, and blockchain, enabling real-world rewards for verifiable on-chain actions.

Participants can acquire tokens at a steep discount before the $0.25 launch price. The presale allocates a significant portion of total supply, positioning early adopters as key ecosystem architects. LivLive transcends gaming—it's an economic framework incentivizing measurable lifestyle improvements through decentralized verification mechanics.

MetaMask Token Launch Speculation Intensifies Amid CEO Comments

ConsenSys CEO Joe Lubin has confirmed plans for a MetaMask token, sparking renewed interest in the self-custody wallet's decentralization roadmap. The Ethereum co-founder offered no concrete details on timing or distribution, but market participants are already weighing in with predictions.

Prediction markets reflect skepticism about an imminent launch. Myriad Markets assigns just a 32% probability to a pre-November debut, while Polymarket traders see a 46% chance of release by year-end. The absence of official snapshots hasn't stopped scammers from exploiting the hype—MetaMask's team recently warned users about fraudulent airdrop claims circulating ahead of March 31.

Lubin's comments mark the most definitive confirmation yet that MetaMask will join the growing list of crypto infrastructure projects launching governance tokens. With over 100 million annual users, the wallet's token could become a bellwether for decentralized identity solutions on Ethereum.

Low-Risk DeFi: Vitalik Buterin’s Vision for Ethereum’s Killer App

Ethereum’s ambition to become the 'world computer' has evolved through multiple phases—smart contracts, ICOs, NFTs, and DeFi. Now, Vitalik Buterin posits low-risk DeFi as Ethereum’s foundational utility, akin to Google’s search function. This shift from speculative playground to reliable financial infrastructure could redefine its ecosystem.

Buterin’s recent post highlights Ethereum’s potential to transcend crypto-casino narratives. Low-risk DeFi, emphasizing stability over speculation, may finally deliver the mass adoption long envisioned. The ETH price trajectory reflects these narrative shifts, from ICO mania to DeFi’s boom-bust cycles.

SharpLink Gaming's $3.75 Billion Ethereum Treasury Accumulation Nears Completion

SharpLink Gaming, a Nasdaq-listed company, has emerged as one of the largest corporate holders of Ethereum with 838,150 ETH in its treasury—valued at $3.75 billion at current prices. The firm began systematically acquiring ETH in mid-2024 through weekly purchases, linking the strategy to a 98.5% year-over-year EPS growth fueled by $774.6 million in unrealized profits.

Recent filings reveal incremental additions of 56,900 ETH and 922 ETH, reflecting a disciplined approach to reserve allocation. With $71.6 million in liquid cash, SharpLink balances crypto exposure with traditional treasury management. Analysts note the 83.8% completion rate of its accumulation target signals impending finalization, a move that could influence ETH's market dynamics.

Is ETH a good investment?

Based on current technical and fundamental analysis, ETH presents a compelling investment opportunity despite short-term volatility. The current price of $4,191.39 represents a potential entry point for long-term investors, though careful risk management is advised.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $4,191.39 | Below MA |

| 20-Day MA | $4,441.56 | Resistance |

| Bollinger Lower | $4,159.09 | Support |

| MACD | -74.10 | Bearish |

BTCC financial analyst Ava suggests: 'While technical indicators show short-term pressure, the strong fundamental backdrop including whale accumulation, network upgrades, and growing institutional adoption supports the case for ETH as a valuable portfolio addition with a long-term perspective.'